Finding the Perfect Solution for Dental Office, Optometry, and Veterinary Practice Loans

Success Stories

In the past 12 months, FiSol has assisted in facilitating over $280 million dollars in loans to hundreds of dentists, veterinarians and optometrists across the United States.

At FiSol we understand the unique needs of medical practitioners. Purchasing and expanding your practice can be a daunting experience. But at FiSol we pride ourselves on demystifying the process of finding dental, optometry, and veterinary practice loans. Whether you are looking to refinance or you need the funding to expand, we can help get you a business loan with favorable terms. When you need dental, veterinary, or optometry practice loans, contact FiSol today!

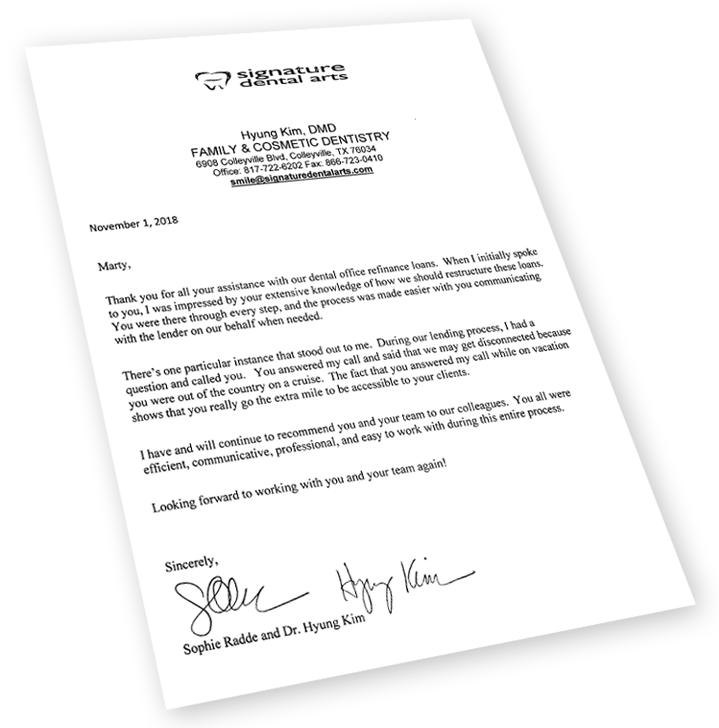

"Thank you for all your assistance with our dental office refinance loans. When I initially spoke to you, I was impressed by your extensive knowledge of how we should restructure these loans. You were there through every step, and the process was made easier with you communicating with the lender on our behalf when needed."

– Sophie Radde and Dr. Hyung Kim, DMD Family & Cosmetic Dentistry, Colleyville, TX

Refinance to save $24,000/year

"FiSol got the cash my practice needed fast!" – Colorado Dentist

The Problem:

Financing a new loan and refinancing existing ones

Our client, owner of two strongly performing practices ($6 million in combined revenue), needed to finance the acquisition of two additional practices quickly, or else risk losing the purchase opportunity altogether. Simultaneously, the dentist needed to refinance the existing practices.

We needed a two-step approach, surpassing the original request and saving a significant amount each month.

Total savings of $24,000 per year!

The FiSol Solution

Two steps to complete

FiSol arranged 100% financing 100% based on the overall strength of the practices, background and experience. The resulting loan secured by the practice was based on an 80% Loan-to-Value. Shortly after successfully closing on the acquisition financing, FiSol arranged a loan of $4,100,000 to refinance the two existing practices.

Practice Acquisition Loan:

$2,700,000

Refinance Loan:

$4,100,000

Rate Reduction:

$24,000 per year

Utah dentist saves $389,000

"After cleaning up my credit, FiSol helped me refinance and save big!" – Utah Dentist

The Problem:

Leveraged improved credit rate to get a lower rate

Our client had obtained a practice loan from a big bank at a high interest rate due to weak credit. The dentist was able to clean up past credit issues and reapplied for a rate reduction with his existing lender. But the bank was unable to reduce his interest rate.

Despite the improving credit profile, the big bank as unwilling to lower our client's high interest rate.

We did it in three days!

The FiSol Solution:

Utilize a refinance program for improving credit

FiSol used one of its portfolio lenders that provide special refinance programs due to improving credit profiles. FiSol obtained a final approval after only three days from submission. The client was able to drop his rate a full 2% and re-amortize the loan from 7 to 15 years.

Practice Refinance:

$389,000

Time Frame to Final Approval:

3 days

Annual Cash Flow Savings:

$11,489

Vet practice financed 100%

"FiSol helped me take advantage of a great opportunity!" – Utah Veterinarian

The Problem:

Two-year associate needed 100% loan financing

Our client, a new associate only two years out of veterinarian school, was offered a practice in which she had worked. The retiring practice owner established a sales price of $1,125,000, but our client had minimal liquidity due to a recent home purchase.

It can be challenging for new associates to acquire a practice, especially with minimal liquidity.

FiSol got her 100% financing in 2 weeks!

The FiSol Solution:

Match our client with the right lender

FiSol chose a lender who was comfortable working with new associates. Our client’s strong credit history provided additional support to offset the lack of liquidity, allowing her to obtain 100% financing.

Practice Acquisition Loan:

$1,125,000

Time Frame to Final Approval:

2 weeks

Optimal Structure:

15-year amortization

From frustrated to financed

"FiSol got me three loans to buy a new practice in just two weeks!" – Southern California Dentist

The Problem:

Getting the loans was taking too long

Our client owned two existing dental practices in Southern California was looking to acquire a third practice from the retiring doctor, but needed to get three loans despite a complicated tax situation.

A traditional firm took over 80 days to attempt to complete the transaction for all three loans.

We did it in 14!

The FiSol Solution:

Simplify & minimize

FiSol eased our client’s cash flow burden by establishing a separate real estate holding company, then simplified the transaction even more to secure a $150,000 working capital line and a 100% loan financing for the three loans.

Practice Acquisition Loan:

$650,000

Practice Real Estate Loan:

$683,000

Working Capital Line:

$150,000

Selected Services:

Future Equipment Needs

Challenge:

Borrower needed to refinance an existing dental practice and purchase a digital x-ray machine worth roughly $150k within 6 months of closing.

Solution & Outcome:

With a $750,000 loan, FiSol's preferred lenders made it possible to refinanced the $600,000 practice, paid outstanding debt and purchased $150,000 of equipment. A “non-revolving” line of credit of $200,000 was established for purchasing future equipment, after which it converted to a commercial term loan and was amortized based on the principal amount used on the line of credit.

Acquisition

Challenge:

Borrower needed to refinance an existing dental practice and purchase a digital x-ray machine worth roughly $150k within 6 months of closing.

Solution & Outcome:

Create a loan to handle a practice acquisition of $375,000 and purchase $150,000 of equipment. FiSol's preferred lender allowed the borrower to use credit by taking out a CD for $45,000 as additional collateral to be held for 1 year or until the loan-to-revenue ratio was met.

First-Time Practice Acquisition

Challenge:

First-time borrower wanted to purchase an underproducing practice from a dentist who had scaled back on hours due to upcoming retirement.

Solution & Outcome:

To secure the necessary $525,000 to complete the acquisition, FiSol's preferred lenders secured a consultant and financed a 1-year consultant fee for the borrower, allowing the loan to close without delay while still having a strong strategic financial and marketing plan in place to ensure future success.

Partnership Buy-In

Challenge:

Pediatric dentist in Tyler, TX, hadn’t yet graduated and had $700,000 in student loans, preventing him from buying in to a practice after graduation.

Solution & Outcome:

FiSol's preferred lenders approved the borrower to buy in to the practice upon graduation with a $1,550,000 loan, allowing the transaction—and the dentist’s career—to move forward.

Acquisition and Added Cash Flow

Challenge:

Two dentists in Houston had recently dissolved their partnership and wanted to buy their own portions of the practice. The deal needed both dentists to be financed individually at the same time.

Solution & Outcome:

Without any restricting covenants, FiSol's preferred lender was able to approve both dentists simultaneously for $425,000 and $410,000, so each could own a practice outright. Additionally, the loan secured each dentist roughly $400 of added cash flow each month.

Partnership Buyout and Refinance

Challenge:

A dentist in Broomfield, CO, owned 2 practices with debt and was buying out the remaining 75% equity from his partner in his second practice. It was important for the dentist to secure a loan quickly and at a 15-year term.

Solution & Outcome:

Practice Pathways was able to consolidate both practice debts into one 15-year term loan of $916,000 for the dentist.